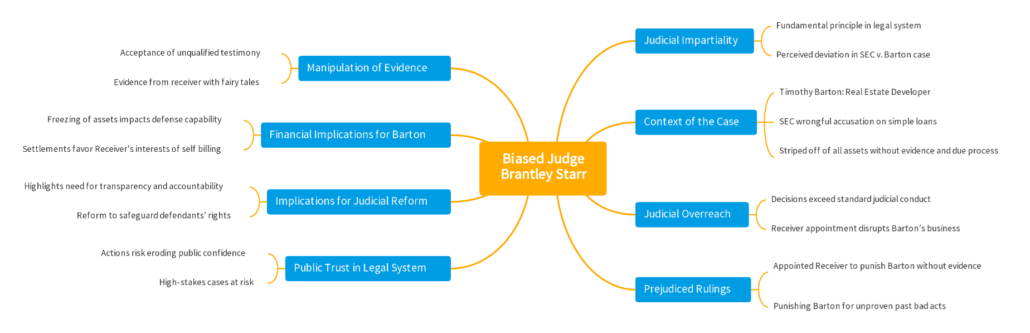

In today’s legal landscape, the principle of impartiality is the cornerstone of justice. However, the case of Timothy Barton v. the SEC stands as a glaring example of judicial bias, unfair overreach, and malicious receivership. The critical figure in this saga is Judge Brantley Starr, whose decisions in the United States District Court for the Northern District of Texas have caused irreparable harm to Mr. Barton and numerous other businesses affected by these rulings.

The Background: SEC v. Timothy Barton

In 2022, Timothy Barton, a well-established real estate developer, found himself the target of an aggressive and unfair investigation led by the Securities and Exchange Commission (SEC). Barton was accused of mismanagement and mishandling of funds related to his business operations. But as evidence would later show, the accusations were unfounded and fueled by an overzealous receiver and a judge determined to impose heavy-handed judgments.

The central figure in these proceedings, Judge Brantley Starr, displayed a level of bias and partiality that goes against the grain of fair judicial practices. His re-appointment of the non-qualified receiver, Cort Thomas, despite overwhelming evidence of mismanagement, exemplifies the underlying partiality in these proceedings.

Judge Starr’s Biased Decisions and Their Devastating Impact

Judge Starr’s rulings have gone beyond the typical scope of judicial oversight. His decisions have allowed the Receiver, Cort Thomas, to exercise undue control over Barton’s assets without proper cause or legal justification. This overreach has resulted in the fire sale of Barton’s properties and the siphoning off of his resources, often in blatant disregard of established real estate and financial norms.

The Drastic Measures Taken by Judge Brantley Starr: Ignoring Judicial Norms in the SEC vs. Barton Case

When faced with legal disputes, courts are expected to balance action with fairness, ensuring all parties receive a just and impartial process. In the ongoing case of SEC vs. Barton, however, Judge Brantley Starr abandoned these principles, opting for some of the most extreme measures that not only defied judicial standards but also inflicted unjust harm upon Timothy Barton.

The Option of a Monitor Ignored

One of the most glaring missteps was Judge Starr’s decision to appoint a receiver with full control over Barton’s assets rather than choosing the more standard option of appointing a “monitor.” A monitor could have kept oversight on Barton’s business dealings while allowing his businesses to continue operating. Instead, Starr opted for a drastic and punitive approach, effectively handing Barton’s entire real estate empire to a receiver — a choice that was neither warranted nor necessary at the early stages of the case.

Even more concerning is the fact that Starr appointed Brown Fox Law PLLC, a company connected to his former clerks and university fellows, to oversee Barton’s assets. This decision disregarded the necessity of having someone experienced in real estate development handle the complex portfolio of properties. By appointing a law firm with no significant real estate background, Starr ensured that Barton’s assets would be mishandled and undervalued, leading to further financial harm.

Why Appoint a Receiver Over a Monitor?

- A Monitor: A court monitor supervises business activities without assuming control, ensuring compliance while allowing business continuity.

- A Receiver: A receiver has total control and can liquidate assets, even without a verdict of guilt.

Appointing a receiver early in a case is akin to punishing a defendant before a trial has even begun — a measure so drastic it only serves to harm the defendant’s ability to defend themselves. Judge Starr’s bias is evident in this choice, which deprived Barton of the opportunity to maintain his business operations, leading to a cascade of negative consequences.

Biased Ruling Without Evidence

Judges are sworn to uphold the principles of impartiality, ensuring that defendants are given a fair trial based on the evidence presented in court. But from the very beginning of SEC vs. Barton, Judge Starr appeared to have made up his mind about Barton’s guilt. Without any evidence, and long before Barton had his day in court, Starr ruled that Barton was involved in securities mishandling.

This prejudgment is a severe breach of judicial ethics, where the presumption of innocence until proven guilty is paramount. Barton’s case was marred by Starr’s premature declarations, which set the tone for a biased legal process that favored the SEC’s unsubstantiated claims. In fact, there was no jury trial, no detailed examination of Barton’s business dealings, and no definitive evidence linking Barton to securities fraud.

The Danger of Prejudicial Rulings

When a judge enters a case with a preconceived notion of guilt, the fairness of the entire process is compromised. Starr’s decision to label Barton guilty of mishandling securities without allowing the defense to present its case illustrates a deeper issue of judicial bias. The legal system is built on the foundation that defendants should have the chance to defend themselves in a fair trial, but Starr’s actions stripped Barton of this right from the start.

This bias not only influenced Starr’s early rulings but also permeated subsequent decisions in the case, ultimately favoring the SEC’s arguments despite the lack of evidence to substantiate their claims.

Cort Thomas — Judge Starr’s Best Weapon

Receivership is a powerful tool in legal disputes, but its power must be wielded carefully. Receivers are supposed to act as neutral parties, managing assets until a legal decision is reached. Yet, in Barton’s case, Judge Starr transformed the role of receiver Cort Thomas into a punitive weapon aimed at dismantling Barton’s empire.

Without any jury trial or proof of wrongdoing, Starr directed Thomas to punish Barton for what he referred to as “past bad acts,” a vague accusation that Starr never substantiated with evidence. Thomas was empowered to take full control of Barton’s assets, and instead of preserving their value for a potential resolution, he set out to liquidate Barton’s holdings as a means of punishment.

The Weaponization of Receivership

Receivership, when used correctly, should be a temporary measure to ensure that assets are maintained during legal proceedings. But Starr’s instructions to Cort Thomas turned this legal tool into a weapon, granting Thomas the authority to punish Barton for unproven accusations. In the American judicial system, defendants are innocent until proven guilty, but Judge Starr and his appointed receiver ignored this foundational principle.

Thomas’ actions were not just punitive; they were also unethical. He began liquidating Barton’s assets without any proper consideration of their market value, further crippling Barton financially before the court had even established his guilt. What kind of judicial system allows such abuses of power? This extreme overreach casts doubt on Starr’s capability to continue serving as a judge.

Granted Control Over 160 Entities Without Proof

If appointing a receiver wasn’t drastic enough, Judge Starr went even further by granting Cort Thomas control over more than 160 entities tied to Barton’s real estate business. What’s shocking about this decision is that there was no clear proof linking these entities to any alleged fraud. Instead of requiring Thomas to trace the funds and establish a direct connection to wrongdoing, Starr gave him unfettered access to Barton’s entire portfolio.

Stripping Barton of Everything

In most cases involving receiverships, the receiver is granted control over only those assets directly connected to the claims at hand. But in Barton’s case, Starr gave Thomas carte blanche to take control of everything — without first proving that Barton’s funds were tainted. This move went beyond standard legal practice, suggesting that Starr was less concerned with justice and more interested in stripping Barton of his wealth.

Thomas wasted no time in using this authority to Barton’s detriment. In one of his first moves, he attempted to sell Barton’s personal home, despite knowing that the sale couldn’t close due to legal complications. To make matters worse, the receiver hid the “as-is” status of the property from potential buyers, violating the Texas Real Estate Code of Ethics. All of this was done with Judge Starr’s approval, further showcasing the unjust collusion between the judge and his chosen receiver.

Starr’s Manipulation of Facts

Judge Starr’s decisions have not gone unnoticed. In fact, his drastic measures have been reprimanded by the Fifth Circuit Court of Appeals, which found his actions to be unjustified and lacking in evidence. However, rather than correcting his mistakes, Starr resorted to manipulating facts and relying on the assistance of his ex-clerk, who had no real qualifications to serve as an accountant in the case.

Manipulating the Record to Justify Wrongdoing

When called to account for his extreme measures, Starr commingled facts with fiction, presenting a distorted narrative to justify his decisions. He ordered Cort Thomas to fabricate reasons for his appointment and presented a fictitious narrative that only served to cover up his judicial missteps. It was clear that Starr was no longer acting as an impartial judge but was instead determined to protect his own reputation — even if that meant prolonging Barton’s suffering.

This kind of judicial manipulation is dangerous. It undermines public trust in the legal system and makes a mockery of the principles of fairness and justice. Starr’s behavior throughout this case suggests that he views himself as above the law, accountable to no one.

Re-Appointment of the Failed Receiver Cort Thomas in 2023

Despite the gross failures of the initial receivership, Judge Starr reappointed Cort Thomas as receiver in November 2023. This decision was baffling, given Thomas’ record of mismanaging Barton’s assets, selling properties far below their market value, and showing little regard for due process.

The decision to reappoint Thomas, despite his clear failures, only served to prolong Barton’s suffering. It also underscored Starr’s determination to punish Barton rather than ensure justice. Thomas’ continued involvement in the case has resulted in the malicious depletion of Barton’s wealth, leaving Barton with little chance of financial recovery.

Freezing Barton’s Assets and Devastating His Businesses

In a striking display of judicial overreach, Judge Brantley Starr imposed a preliminary injunction that froze the assets of Timothy Barton, leaving him unable to defend himself or continue operating his businesses. This decision, made without due regard for the broader economic realities of Barton’s enterprises, effectively dismantled Barton’s ability to function as a businessman, stripped him of liquidity, and compromised his legal defense against the Securities and Exchange Commission (SEC) and the court-appointed receiver.

The Impact of Freezing Assets on Barton’s Defense

The freezing of Barton’s assets meant that he was left without access to the very resources he needed to mount a proper defense. The inability to use his own funds for legal expenses and to keep his businesses afloat left him at the mercy of a biased judicial system, designed to weaken his standing before the court. Without funds to pay his legal team or sustain his operations, Barton was plunged into a precarious position where defending himself became nearly impossible.

Beyond the legal ramifications, Judge Starr’s decision completely disregarded the broader economic consequences of such an injunction. Real estate businesses, like Barton’s, are inherently dependent on liquid capital to function. By freezing Barton’s assets, Starr effectively crippled his ability to manage his properties, meet operational expenses, or honor business commitments. The resulting cash flow crisis caused a ripple effect, severely undermining the financial stability of Barton’s enterprises.

Precedent for a More Thoughtful Approach

Historically, courts have imposed targeted injunctions that focus only on disputed assets, thereby allowing businesses to maintain operations. But Starr’s blanket approach showed no such prudence. Instead of isolating the allegedly tainted funds, Starr froze all of Barton’s resources, making it clear that his objective was not to ensure fairness but rather to hamstring Barton and render him defenseless.

This case exposes a worrying precedent for future injunctions, where economic realities are ignored in favor of heavy-handed judicial control, leading to the demise of legitimate business operations without any proven wrongdoing.

From Asset Protection to Self-Dealing

In the world of corporate litigation, receivership is meant to be a safeguard, a mechanism to manage and protect assets while claims are adjudicated. However, under Judge Starr’s watch, receivership in Barton’s case became a tool for self-enrichment rather than asset preservation. Cort Thomas, the court-appointed receiver, failed miserably in his fiduciary duty, using the power of receivership to mismanage funds and funnel assets into legal fees that propped up a case that should have been dismissed long ago.

Neglecting Basic Financial Responsibilities

One of the core responsibilities of a receiver is to protect and preserve the assets in question — paying off mortgages, addressing debts, and ensuring that businesses maintain their value. In Barton’s case, however, Thomas failed to meet these obligations. Instead of paying off debts and maintaining the financial health of Barton’s estate, Thomas used the assets to enrich himself and his legal team. Mortgages went unpaid, businesses were neglected, and properties lost value, all while Thomas diverted funds to pay for mounting legal bills.

This mismanagement stands in stark contrast to the very purpose of receivership, which is to act in the best interest of the estate and its stakeholders. Instead, Thomas focused on lining his own pockets, draining Barton’s assets without making any meaningful progress toward resolving the underlying issues in the case.

Self-Dealing vs. Fiduciary Duty

The receiver’s primary duty is to act in the best interest of the estate, ensuring that creditors, lenders, and other stakeholders are fairly represented. But in this case, Thomas engaged in self-dealing, using his control over Barton’s assets to prolong the litigation and drain the estate. This failure to prioritize the real financial health of the estate resulted in a total disregard for Barton’s creditors, who were left in limbo while the receiver enriched himself at Barton’s expense.

Judge Starr Sides With the Receiver at Every Turn

In every litigation, both sides present arguments and objections, with the expectation that the judge will weigh these carefully and make decisions based on the strength of the evidence. However, in the SEC vs. Barton case, Judge Starr consistently ignored the objections of Barton’s counsel, despite their strong legal grounds and well-reasoned arguments. Instead, Starr granted every request made by the receiver, raising serious concerns about the judge’s impartiality.

A Courtroom That Refused to Listen

Throughout the proceedings, Barton’s legal team put forth numerous objections — to the appointment of the receiver, to the handling of Barton’s assets, and to the evidence presented by the SEC and the receiver. These objections were grounded in strong legal precedent and pointed to clear violations of Barton’s rights. Yet, Starr consistently refused to rule on any of these objections, leaving Barton’s counsel with no recourse but to watch as the receiver continued to erode Barton’s estate.

In a judicial system where the right to a fair trial is supposed to be sacrosanct, Starr’s unwillingness to engage with the objections raised by Barton’s team suggests that the outcome of the case was predetermined. Whether intentional or not, Starr allowed the receiver to control the narrative, ignoring valid legal arguments that could have changed the trajectory of the case.

Who is Really Running the Show?

The way Judge Starr handled Barton’s case has led many to question who was truly running the show — the judge or the receiver? Starr’s repeated deference to the receiver’s demands, coupled with his refusal to acknowledge Barton’s objections, paints a picture of a courtroom where the receiver held all the power. In fact, it has become clear that either the judge was complicit in the receiver’s actions, or the receiver was manipulating the case through Starr. Either scenario points to a severe breakdown in the judicial process.

A Betrayal of Legal Standards – Acceptance of Undue Evidence:

One of the most alarming aspects of the SEC vs. Barton case has been Judge Starr’s acceptance of evidence from the receiver, despite its questionable origins and lack of legal validity. In legal proceedings, evidence should come from the plaintiff (the SEC) or the defendant (Barton), and it must meet rigorous standards to be admitted in court. Yet, Starr has consistently accepted non-standard evidence from the receiver, disregarding the basic rules of legal procedure.

Unqualified Testimony and Non-Accountant Tracing

Perhaps the most egregious example of this was the judge’s acceptance of financial tracing performed by the receiver’s clerk, who had no qualifications as an accountant. Despite lacking the proper training to trace financial transactions, the clerk’s work was admitted as evidence, and Starr accepted it without question. This unqualified testimony, which did not differentiate between tainted and non-tainted funds, was used to bolster the receiver’s claims against Barton.

A Judicial System

Where Judge Starr & his liked receiver Cort Thomas pull the levers

Defendant can only watch

Further complicating matters, the receiver’s testimony included false characterizations of Barton’s assets. A personal home was labeled as an “apartment project,” and funds that never touched Barton’s entities were claimed to be part of the estate’s alleged fraud. Starr’s willingness to accept this fictitious evidence violated legal norms and betrayed the very concept of fair trial.

/

Punishing Barton While Filling Receiver’s Pockets

Real estate development, by nature, is fraught with litigation. The process of dealing with lenders and other stakeholders often involves legal disputes. In Barton’s case, these disputes were ongoing long before the SEC’s involvement. However, Judge Starr, in his biased ruling, consistently approved settlements with Barton’s lenders without considering the solid objections raised by Barton’s legal team.

Settlements That Favor the Receiver, Not Justice

Starr’s approval of these settlements had little to do with resolving disputes and everything to do with filling the receiver’s legal pockets. Rather than taking into account the valid claims made by Barton’s team, Starr sided with the receiver, allowing settlements to go through that benefited the lenders and the receiver’s legal team, but left Barton’s estate in tatters.

These settlements, which netted pennies on the dollar, were far below what Barton’s properties were worth. Instead of protecting Barton’s assets, Starr and the receiver appeared to be on a mission to punish Barton for reasons unrelated to the case at hand.

The Real Motive: Punishment, Not Protection

By approving settlements that harmed Barton’s estate while enriching the receiver, Starr’s true motive became clear. Rather than ensuring that assets were protected or that lenders were fairly compensated, Starr’s rulings were designed to cripple Barton and ensure that his estate was drained to fund the receiver’s legal fees.

A System Designed to Destroy

Throughout the SEC vs. Barton case, the actions of Judge Brantley Starr and Receiver Cort Thomas have illustrated a system designed to destroy rather than to uphold justice. From prejudicial rulings to self-serving misuse of receivership powers, Starr’s courtroom has become a place where due process is ignored, objections are dismissed, and evidence is manipulated to serve the interests of the receiver.

Barton’s fight is far from over, but this case highlights the urgent need for reform in the judicial process and calls.